Streamlining Insurance Agencies With Specialized Call Center Services

Having a call center for insurance agencies can bring numerous benefits and be the key to boosting the business. But, first of all, let’s understand what they are and why they can help you. Call centers emerged from the influences of some techniques of marketing, sales, telecommunications, and corporate telephone answering services. Today, revenue in the sector represents an important business segment in the country, growing at 8% per year and reaching R$21 billion annually.

Also called telemarketing or SAC (Customer Service), call centers grew after the popularization of the Telebrás system in 1988. This modality emerged by expanding the Consumer Protection Code sector, which said that companies should provide a service to meet customer requests. Soon, having a call center became more than a means of answering customer requests; it was a profitable way to obtain new business. The call center at the credit agency began to bring evident benefits.

This is because these services are normally outsourced. This further helps leverage the market. Outsourcing is more efficient because it has professionals prepared to help with a certain function, saving companies from extra training with a team of employees.

The call center like Hit Rate Solutions for example at the insurance agency is just one of the areas of activity. This modality can also be present in Customer Service (SAC), sales of products or services, and billing.

Positive Points Of The Call Center At The Insurance Agency:

Interactivity with the customer: brings the relationship between company and customer closer because the telephone adds a personal tone to the relationship;

Versatility: Telemarketing strategies can be modified and adapted quickly;

Optimization: A lot of information can be passed on in just one call;

Control: Calls can be recorded and monitored closely;

Focus: Different conditions can be applied to large groups of customers;

Coverage: no distance limit;

Convenience: The salesperson does not need to leave their chair to make a sale;

Cost: It’s cheaper to sell over the phone;

Speed: More than 70 direct customer conversations can be made per day.

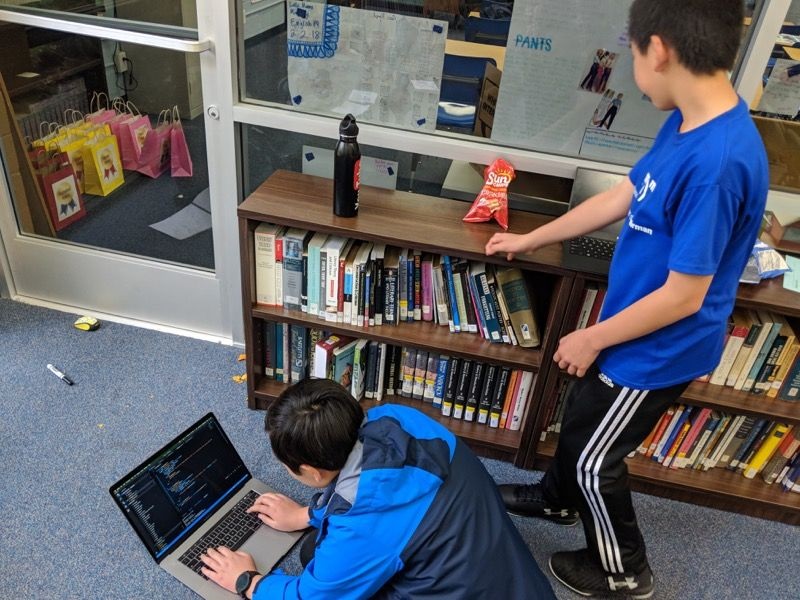

The sector has also become a gateway to the job market for young people and university students.

Eventually, the call center service is contracted by banks, insurance agencies, retail stores, insurance companies, health plans, and publishers. Whether there is a boom in the market or when there is a crisis, the most sought-after service is sales. However, in times of crisis, the demand for collections services also increases.

Just like in any other economic sector, the return is not immediate in this branch of call centers. It is necessary to monitor all operations, always seeking to improve operators’ productivity, especially working to reduce service time, make more quality calls, and invest in options such as IVR and Callback. With the call center at the credit agency working, it is possible to profit and take advantage of the growing market through this well-structured and qualified service.